Today we would like to share our mostly qualitative and admittedly unscientific thoughts on why we believe that condominiums may turn out to be poor long-term investments. Although it is impossible for anyone to predict the future outcome of any investment, we feel that it would at least be prudent for anyone contemplating buying a condo to consider these ideas before making such a purchase.

1) Buildings are Depreciating Assets

Just as with any man made object, buildings are depreciating assets. That is to say that their value gradually diminishes with every passing day as they are damaged through wear and tear and exposure to the elements and as they become stylistically and functionally outdated. Given enough time, the value of any building will reach zero and the original “investment” will be lost. Just as today’s flashy new car that was just driven off the dealer’s lot will one day end up in the scrap yard, today’s gleaming new Toronto condo tower will eventually need to be demolished and rebuilt.

Proof that buildings are depreciating assets can be found by looking at how the Canada Revenue Agency treats buildings for income tax purposes. The CRA clearly considers buildings (such as that brand new condo tower in the heart of downtown Toronto) to be a depreciating asset and, as such, allows investors to deduct this annual depreciation from their rental income as a “Capital Cost Alowance”:

“You might acquire a

depreciable property such as a building, furniture, or equipment to use in your business or professional activities. […]

since these properties wear out or become obsolete over time, you can deduct their cost over a period of several years. This yearly deduction is called a capital cost allowance (CCA)”

1

That is right. The tax authorities in this country consider buildings to be similar to furniture or business equipment or motor vehicles in that they naturally depreciate in value over the years until they reach the end of their useful economic lives and need to be demolished and replaced.

How quickly might a building depreciate? Clearly not as quickly as a car which may only last ten to fifteen years. The rate of depreciation is admittedly far more gradual and almost imperceptible, but is still very much present. The Canada Revenue Agency classifies buildings as belonging to “Class 1” depreciable property, which may depreciate at a rate of up to 4% per year:

"Class 1 (4%) includes most buildings acquired after 1987, unless they specifically belong in another class. Class 1 also includes the cost of certain additions or alterations you made to a Class 1 building or certain buildings of another class after 1987."

2

Certain buildings are even considered by the CRA to depreciate at a rate of up to 10 percent per year such as log or stucco homes built prior to 1979.

2

Further evidence that buildings do depreciate in value can be found by looking at numerous examples of buildings in our cities that have reached the end of their useful economic lives and have been demolished to make way for new development. Here are but a few recent examples in the City of Toronto:

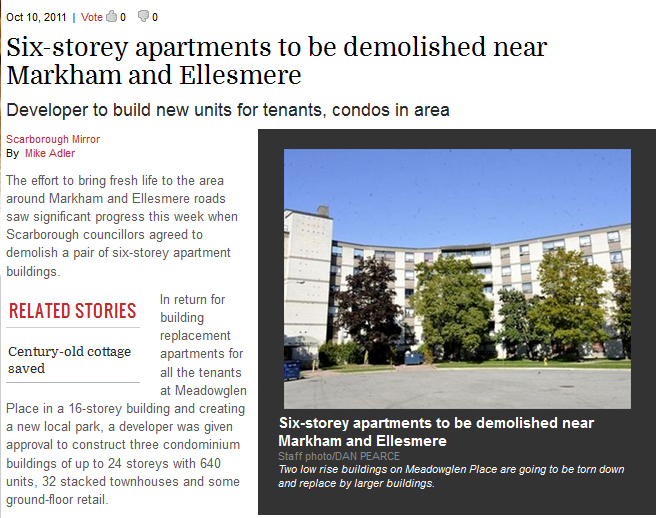

October 10, 2011, Scarborough Mirror:

Six-storey apartments to be demolished near Markham and Ellesmere, Developer to build new units for tenants, condos in area .

« Adam Brown, representing R.A.B Properties Ltd., also thanked the community for the process he said would replace rental units "which are at the end of their life" with new ones »

3.

Figure 1: Apartment buildings in Toronto near Markham and Ellesmere about to be demolished because they have reached the end of their useful economic lives.

Figure 1: Apartment buildings in Toronto near Markham and Ellesmere about to be demolished because they have reached the end of their useful economic lives.

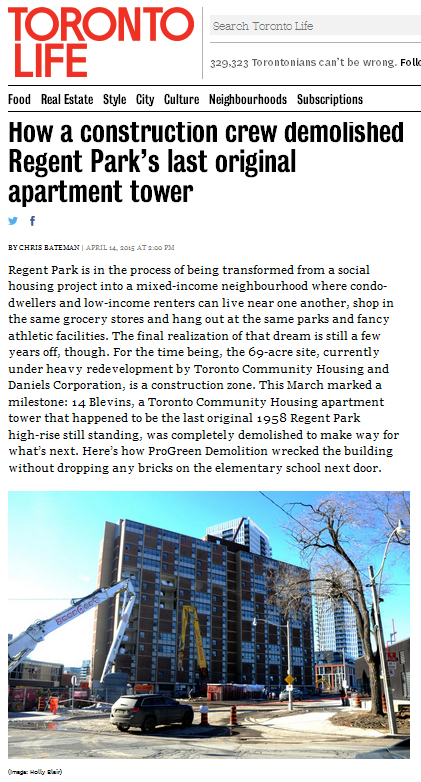

April 14, 2015, Toronto Life:

A high-rise building built in 1958 is demolished in Toronto’s Regent Park neighbourhood after a mere 57 years

4.

Figure 2: Apartment building in Toronto's Regeant Park neighbourhood about to be demolished because it has reached the end of its life cycle.

Figure 2: Apartment building in Toronto's Regeant Park neighbourhood about to be demolished because it has reached the end of its life cycle.

If these buildings have reached the end of their useful lives after only 50 or 60 years, it is possible to imagine today’s new condo towers also reaching theirs within a similar time frame especially when one considers that the siding for these new towers is primarily made of glass which is not considered to be as durable as brick or cement.

It could be argued that with adequate maintenance, the depreciation on a building can be slowed or even arrested. One could think of some very old buildings that are still in their original state. For example, consider Canada’s Parliament Buildings or the historic buildings that dot the landscape of the University of Toronto’s St. George campus or the Notre Dame basilica in old Montreal. Are these not evidence that with proper maintenance buildings can last forever? We would argue that these examples merely illustrate that the cost of maintaining ageing buildings in their near-original state is staggering, far exceeds the cost of simply replacing them and that in the end almost every part of these buildings needs to be replaced such that we are left with essentially a new building. Consider that the cost of renovating the West Block of Canada’s parliament has recently surpassed one billion dollars

5 and that the University of Toronto must spend approximately 19 million dollars a year to maintain its buildings in their current conditions

6.

The fact that an asset depreciates does not in itself preclude you from purchasing it. After all, cars, furniture and computers are all depreciating assets that certainly serve useful purposes and are worth owning even if they will one day be worthless and will need to be replaced. Likewise a condo does serve a useful purpose in that it provides shelter. However, prospective condo owners should be mindful of the fact that they will be purchasing a depreciating asset which they may not be able to resell for as much as they originally paid and which they may one day, in the hopefully distant future, need to replace.

2) Land is Finite but Condo Units are Not

There is a fixed amount of land available for construction in any given city or region. For example, the City of Toronto has a surface area of 630.2 square kilometres. This surface area obviously cannot be increased regardless of how many more people are added to the city’s population every year. If you own a parcel of land within a city, you own a certain percentage of the city’s total surface area; a percentage that is fixed and will never change. As the city’s population increases and density increases, you could expect the value of your land to increase as well. This is why single-family homes have appreciated so much in recent years in our major urban centres such as Toronto and Vancouver. It is not because the value of these houses themselves have increased (since, they are, after all, buildings which as we discussed previously are depreciating assets) but rather it is the value of the land on which these houses are built that has increased so dramatically in value.

There is, on the other hand, practically no limit on the number of condo units that can be added to a city. Developers can always find another vacant parking lot, another old mall or another set of low rise houses to redevelop into yet another soaring condominium tower. And there is almost no limit to how tall these towers can be built and to how many apartment units they can contain. How then could anyone expect significant price appreciation for a condo unit when, unlike with land, there is no constraint on the number of such units that can be built in the vicinity.

High-rise condo owners own no land. They own a share of a condominium which itself does own some land, but the land that is attributable to their particular unit is miniscule. The high-rise condominium investor has opted to buy an investment that is entirely a building (a depreciating asset) and which has no land (an appreciating asset).

Given this reality it should not be surprising to anyone to see the values of single-detached and semi-detached homes increase much more rapidly than those of high-rise condo units in our major urban centres. The value of apartment condo units in the City of Toronto proper, for example, increased by approximately 4.88% between January 2015 and January 2016 while the value of single detached homes increased by 11.29% over this same period

7. The numbers for January 2014 to January 2015 were 3.97% for high-rise condo units vs. 7.84% for single detached homes

8.

What is more remarkable, perhaps, is that the high-rise condo units increased in value at all during those time periods given that they are, ultimately, depreciating assets. It could be that developers have simply been unable to keep pace with the demand for housing in the city of Toronto or that the costs to build new towers has increased (cost of labour, materials, etc…) which has increased the replacement cost of an apartment unit and, in so doing, has led to an increase in the value of resale high-rise condo units. Still, we would not be confident of this trend continuing ad infinitum.

3) There are Significant Limits of Freedom Imposed on a Condo Owner

One of the reasons people often cite for purchasing real estate is the idea of gaining greater control over their shelter. Prospective real estate owners look forward to being able to paint the walls in a colour that pleases them, to renovate their home as they see fit and to escape from living “under the thumb of a landlord”. And yet, very little control is gained by purchasing a condo. The tyranny of a landlord is replaced by that of a condo board. Condo rules can stipulate requirements for the type of flooring or carpeting that can be installed within a unit. These rules can also limit what types of pets, if any, can be kept, whether children are allowed to reside in the units and how late into the evening a dishwasher or washing machine can be operated. There is nothing a condo unit owner can do moreover to change the exterior appearance of their building.

Tenants arguably have more control over the circumstances of their shelter as they can pack up and move to another building whenever it pleases them with only sixty days notice and at a negligible cost.

Owners of single detached homes, although limited to some extent by city bylaws, also enjoy greater control over the state of their homes.

4) There is a Loss of Control Over the Timing and Costs of Maintenance

A condo owner has control neither over the costs of maintaining his or her building nor over the timing of these costs. A condo board or property management company will decide what maintenance needs to be done, at what cost and when the work is to be completed. The property manager or board may not always necessarily choose the least expensive contractor and may choose to complete work that is not absolutely necessary. If major unforeseen repairs are required, a one time “special assessment” can also be levied on the condo owners.

A freehold owner of a single detached or semi-detached home on the other hand can choose to complete some of the maintenance work on his own to reduce costs. He can cut his own grass, empty his own eaves troughs and shovel his own snow. If he wishes to outsource this work, he can choose to hire the kid next door to cut the grass and clear the snow instead of a professional, and more expensive, contractor.

He can also, to some extent, control the timing of these costs by choosing to defer work if his own economic situation is such that he cannot afford the repairs this year. An ageing roof can be stretched out for a few more years. The walls can be repainted another year. The old furnace in the basement can be kept for one more winter. No such control over the timing of maintenance costs is possible with a condo: the condo fee is due on the first of each month regardless of the owner’s own economic situation.

Conclusion

We would urge all prospective condo owners to at least think of these ideas before taking the plunge.

There is nothing inherently wrong in purchasing a condo. Just as a car provides transportation, a condo provides shelter. However, we believe that high-rise condominium units should not be viewed as good long-term investments and that there is a reasonable likelihood that they will lose much of their value over the coming decades. Prospective condo owners need to understand the true nature of the manufactured good that they are purchasing and should be careful not to overpay for it.

Please let us know your thoughts or experience with condo ownership in our comments section.

DollarGuide.ca