With a new year upon us, it is time for all Canadians to begin thinking about putting money aside in a tax-free savings account.

These accounts have been available since 2009 and allow all Canadians who are eighteen years of age or older to contribute up to their contribution limit. This limit increases each year on January 1st. Although the Canada Revenue Agency website does not yet seem to indicate by how much everyone's contribution limit will increase on January 1, 2014

1, a number of sources indicate that it will be $5,500.00 this year as it was in 2013. For example, ING Direct is advertising a kick-start account that indicates a contribution limit of $5,500.00.

2 It has also been announced in the general financial media that the CRA has announced that the limit will be $5,500.00 as it was in 2013.

3 It is remaining the same as it was in 2013 because inflation was not elevated enough throughout 2013 to justify increasing it by another $500.00 to $6000.00.

Although the amount that you can add to your TFSA is increasing by $5,500 this year, to determine how much money you can actually transfer into your account, you will have to add up the contribution limits from past years and subtract from that total any amounts that you have contributed in prior years.

For example, if you were at least 18 years of age in 2009, your total contribution room would be $5000 (for 2009) plus $5000 (for 2010) plus $5000 (for 2011) plus $5000 (for 2012) plus $5500 (for 2013) plus $5500 (for 2014) for a grand total of $31 000 dollars. Subtract from that 31 grand any amount that you added in past years and you will be left with the amount that you can transfer into your TFSA account this year.

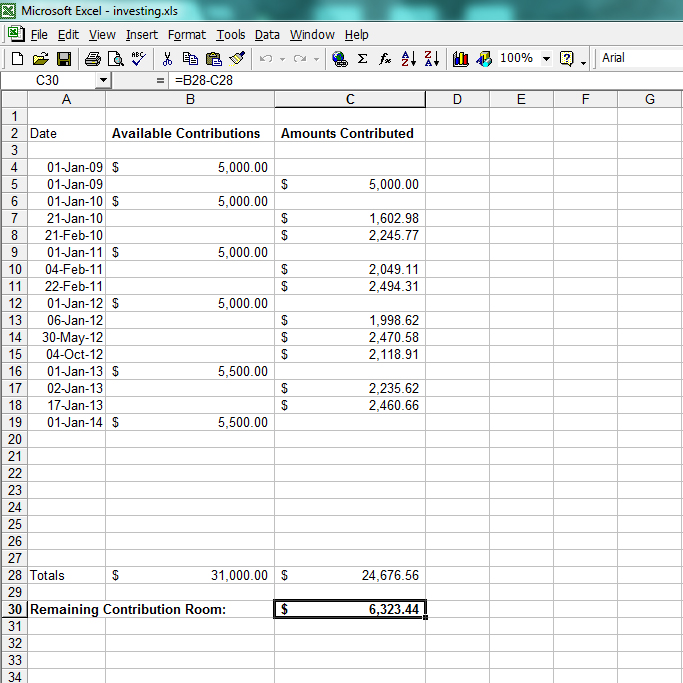

The easiest way to keep track of this is to create an Excel spreadsheet. Create three columns, one called "Date", one called "Available Contributions" and one called "Amounts Contributed". On January 1st of each year, you can add that year's contribution limit increase (example: $5500) to the "Available Contributions" column. Then whenever you happen to transfer money into your TFSA throughout the year, create an entry under the column "Amounts Contributed". Sum up the value of both columns and then have another cell in the spreadsheet where you subtract the total of the "Amounts Contributed" column from the total of the "Available Contributions" column. That cell will allow you to easily figure out, at any given point in time, how much money you have available to contribute to your TFSA. The following is a snapshot of what this could look like in Microsoft Excel (or any other spreadsheet software that you might want to use):

Figure 1: With spreadsheet software like Excel, it's easy to keep track of your TFSA contribution space.

Figure 1: With spreadsheet software like Excel, it's easy to keep track of your TFSA contribution space.

Does that sound like too much work? Well, you could also easily do the same on a piece of paper and use a calculator to determine your contribution space.

Apparently it is also possible to simply ask the CRA what your TFSA contribution limit is as they are also keeping track of this. You can find out how much room you have left by using their online "My Account" service or by calling the Tax Information Phone Service (also known as TIPS).

4

Although simpler in some ways, one major caveat with these methods is that the CRA only knows about your contributions in February of each year!

4 Therefore these numbers will be meaningless if it's not yet February or if you have made contributions after February of that year.

One last tip, remember not to overcontribute to your TFSA, as there are penalties for doing so.